Why Should We Take Secured Business Loans

Secured business loans are loans which are offered to people who are a little short on money to either start their business or to increase the size or the capacity in which the business is operating in.

A secured business loan is a good option for people who have decided to go ahead with meeting their business needs. The first thing that a borrower must consider before going in for a secured business loan is that he should have a security ready with him. It is a prime clause for taking a secured business loan. A security can be any worthwhile asset that a borrower may possess it can be his home, his car or the business premises in which the main business operations of the business take place.

It is easy to understand why the experts always seem to advice going in for secured business loans as suppose to the other forms of business loans, with the range of benefits it is not difficult to fathom. A businessman can avail the following benefits by going in for secured business loans.

• Secured business loans come at an interest rate which is lower than what may be offered when an unsecured business loan is taken.

• With the secured business loans the borrower can choose his terms i.e. the monthly installments and the period of repayment which help in the long term use of the loan.

• With secured business loans we can choose between the whole range of amount available for the loan which can help in using of the loan better.

The only disappointing thing about the secured loans is that not everyone can afford them and can avail these loans as not everyone is capable of providing a security. However, those who can take full benefits of the loan if they utilize their loans properly.

A borrower can make the following uses of secured business loans.

• To start a new business

• For buying new assets, machines or premises for a business

• Short term business loans for people running business on credit transactions.

• To increase the current business capacity or to launch a new business area.

Reason may be any one thing is for sure that business loans will always be there to help you.

Applying for secured business loans is easy all you need to do is estimate your requirement and then find a lender who will provide you with these loans. Secured business loan usually gets approved in a week or two. So people who want to apply for the loan need to do it with due care and all the details at their disposal.

- Share

YOU MIGHT ALSO ENJOY

Why Choose a Dumpster Rental for Junk Removal in Northwest Arkansas?

Stephen Romero - March 7, 2025

How Can Industrial Racking Improve Warehouse Organization?

Stephen Romero - March 7, 2025

Why Choose a Professional Dog Trainer in Bradenton for Your Pet?

Stephen Romero - March 7, 2025

search

must read

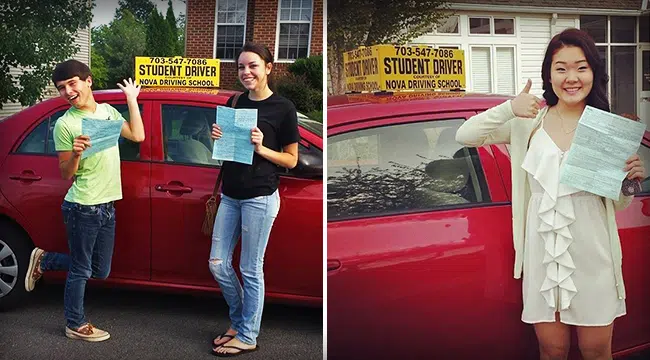

The Ultimate Guide to Finding the Best Driving School Near Me in Springfield

Stephen Romero - March 7, 2025

recent post

ARCHIVES

- March 2025 (8)

- February 2025 (9)

- January 2025 (8)

- December 2024 (25)

- November 2024 (40)

- October 2024 (11)

- September 2024 (1)

- July 2024 (10)

- June 2024 (11)

- May 2024 (31)

- April 2024 (15)

- March 2024 (19)

- February 2024 (6)

- January 2024 (7)

- December 2023 (11)

- November 2023 (1)

- July 2023 (13)

- June 2023 (21)

- May 2023 (27)

- April 2023 (23)

- March 2023 (16)

- February 2023 (31)

- January 2023 (27)

- December 2022 (11)

- November 2022 (12)

- October 2022 (11)

- September 2022 (11)

- August 2022 (14)

- July 2022 (13)

- June 2022 (19)

- May 2022 (17)

- April 2022 (10)

- March 2022 (12)

- February 2022 (8)

- January 2022 (9)

- December 2021 (19)

- November 2021 (4)

- October 2021 (6)

- September 2021 (4)

- August 2021 (4)

- July 2021 (10)

- June 2021 (6)

- May 2021 (2)

- April 2021 (2)

- March 2021 (45)

- August 2020 (31)

- July 2020 (30)

- June 2020 (29)