Share Trading Tips – Contracts For Differences

HINT: TRADE THE FACTS

The same rules apply to CFDs as they do to share trading – In essence, they’re both about getting the direction of the instrument correct. Trading on rumours is a classic investor trait, which can often lead to losses as the event never materialises and the share price falls back.

HINT: DIVERSIFICATION

Overexposure in one particular asset class can quickly lead to losses (and gains). Diversifying your risk is well regarded amongst the most successful investors as the best way to reduce risk. Reducing risk can come in a variety of guises from investing in different sectors, taking short as well as long positions – creating a market neutral portfolio and trading across different markets. The most popular way of diversifying is by taking a position in an index, as opposed to the individual constituents. This way the impact of a large movement in a particular share, or even sector, will have less of an impact. Although you should always place a stop on your positions, it is particularly prudent with more exposed portfolios.

HINT: DO YOUR RESEARCH

Most CFD trading firms provide a range of research resources including charting, news and company information to keep you informed and help you make informed investment decisions. Keep yourself informed and up to date by making the most of the research centre.

TIP: DON’T OVERTRADE

Every investor has their own style of trading and you must decide what works for you. Just because you have the ability to trade frequently, doesn’t mean you have to! With competitive commissions and a high liquidity, the FX market is a classic example of where there can be literally dozens of trading opportunities throughout the day. You don’t have to trade every one of them to have a successful day.

TIP: CUTTING LOSSES

You will have losing trades. Decide on the amount you are willing to lose before you place the trade and stick to it. If you haven’t got the self-discipline to trade out of a losing position, place a stop on the trading platform and let the system do the hard work for you. The most successful traders are those who are very regimental in their use of stops. Quite simply, they rarely lose more money than they were initially prepared to lose. There are plenty of more opportunities, as long as you have retained the capital to take advantage of them!

TIP: UNDERSTANDING YOUR MARKET

Most CFD firms provide access to a range of global financial markets for you to trade. This wide selection is not an invitation to trade every market possible – it’s to provide a choice. As well as fully understanding the market and the news and data which impact its movements, make sure you fully understand how Barclays Stockbrokers offers the instruments and under what terms. Trade what you know.

TIP: CREATE TRADING TARGETS

Every trade should be entered into with one clear exit target if the trade is profitable and another for a losing trade. Limit and Stop orders are crucial to helping you achieve this. Don’t let a short-term trade become a long-term investment by not placing a stop. Moving your stop loss closer to the market price as your position becomes profitable allows greater flexibility in setting targets. You don’t have to call the very top or bottom of the market to regularly make money.

TIP: DON’T BE EMOTIONAL

CFDs are a very exciting way of trading, but don’t let emotion take over. The market is never wrong – and don’t try to prove otherwise. Sometimes the greatest discipline is to avoid the trade altogether. Like any good dealmaker – if the price isn’t right, walk away. Plan your trade and trade your plan.

TIP: MANAGING YOUR MONEY

Thrilling, exhilarating, gripping…. but these emotions will become few and far between without a sound, business-like approach to your CFD trading. Before you even start – only risk what you can afford to lose. Once you have established what proportion of your investment funds should be apportioned to CFDs you need to further break down your collateral into how much you are willing to lose on each individual trade. Then stick to this!

- Share

YOU MIGHT ALSO ENJOY

Google Loses Market Share and MSN Gains

Stephen Romero - March 27, 2021

Marketing Success Defined

Stephen Romero - March 27, 2021

Time Share Resale

Stephen Romero - March 27, 2021

search

must read

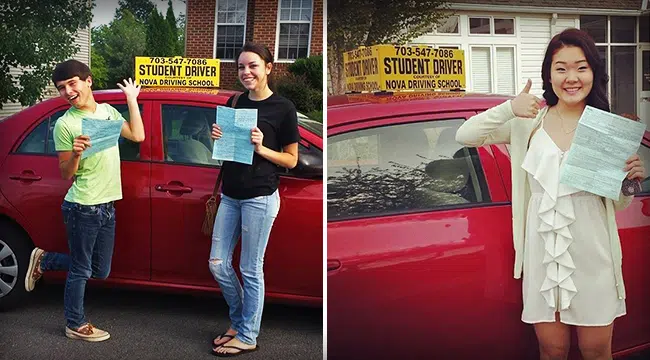

The Ultimate Guide to Finding the Best Driving School Near Me in Springfield

Stephen Romero - March 7, 2025

recent post

ARCHIVES

- April 2025 (1)

- March 2025 (8)

- February 2025 (9)

- January 2025 (8)

- December 2024 (25)

- November 2024 (40)

- October 2024 (11)

- September 2024 (1)

- July 2024 (10)

- June 2024 (11)

- May 2024 (31)

- April 2024 (15)

- March 2024 (19)

- February 2024 (6)

- January 2024 (7)

- December 2023 (11)

- November 2023 (1)

- July 2023 (13)

- June 2023 (21)

- May 2023 (27)

- April 2023 (23)

- March 2023 (16)

- February 2023 (31)

- January 2023 (27)

- December 2022 (11)

- November 2022 (12)

- October 2022 (11)

- September 2022 (11)

- August 2022 (14)

- July 2022 (13)

- June 2022 (19)

- May 2022 (17)

- April 2022 (10)

- March 2022 (12)

- February 2022 (8)

- January 2022 (9)

- December 2021 (19)

- November 2021 (4)

- October 2021 (6)

- September 2021 (4)

- August 2021 (4)

- July 2021 (10)

- June 2021 (6)

- May 2021 (2)

- April 2021 (2)

- March 2021 (45)

- August 2020 (31)

- July 2020 (30)

- June 2020 (29)